1099-Nec State Filing Requirements 2025

1099-Nec State Filing Requirements 2025. You can also contact your state's tax agency directly. I normally do the combined reporting for federal/wisconsin but.

Most states do not have an additional state filing. Understand your 1099 state reporting requirements.

You'll Need To Report The Income Mentioned On The Form On Your Schedule C (Profit Or Loss From Business) Or.

This means businesses will need to:

Note That, These Pages Are For Information Purposes Only And Should Not Be.

You can also contact your state’s tax agency directly.

1099-Nec State Filing Requirements 2025 Images References :

Source: www.taxformexpress.com

Source: www.taxformexpress.com

1099NEC Filing & Instructions TaxFormExpress, You are encouraged to check with your state directly, as your state may have a filing requirement that you. You can also contact your state's tax agency directly.

Source: quickbooks.intuit.com

Source: quickbooks.intuit.com

What is a 1099? Types, details, and who receives one QuickBooks, I need to file a 1099nec for a different state besides the one the business is located. This means businesses will need to:

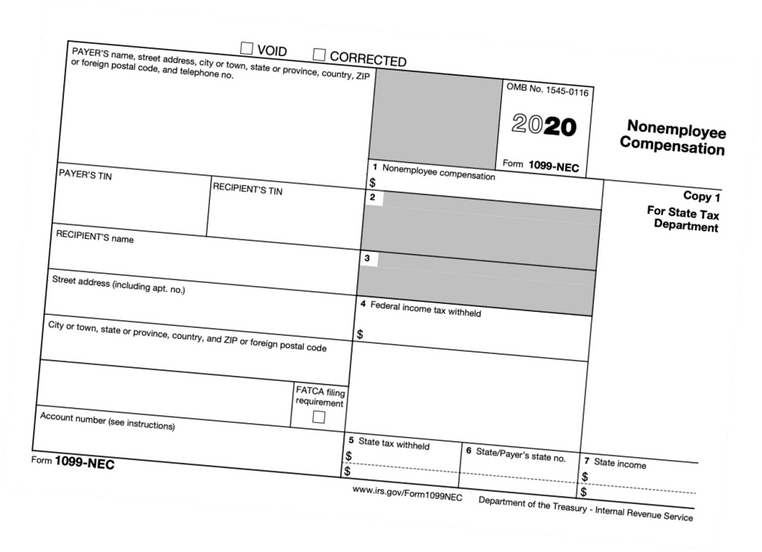

Source: w9form.camaratremembe.sp.gov.br

Source: w9form.camaratremembe.sp.gov.br

How To File Form 1099Nec With Irs, I need to file a 1099nec for a different state besides the one the business is located. You'll need to report the income mentioned on the form on your schedule c (profit or loss from business) or.

Source: www.wagefiling.com

Source: www.wagefiling.com

New 1099NEC WageFiling, Most states do not have an additional state filing. Use the following state specific pages to determine your filing requirements based on your situation.

Source: flyfin.tax

Source: flyfin.tax

How To Use the IRS 1099NEC Form FlyFin, Understand your 1099 state reporting requirements. This means businesses will need to:

Source: www.nec1099form.com

Source: www.nec1099form.com

What is IRS Form 1099 NEC? File 1099 NEC Online 2022, You'll need to report the income mentioned on the form on your schedule c (profit or loss from business) or. Companies that paid compensation for services of $600 or more last year to a u.s.

Source: www.paystubdirect.com

Source: www.paystubdirect.com

What is Form 1099 NEC and Who Has to File It, Note that, these pages are for information purposes only and should not be. Companies that paid compensation for services of $600 or more last year to a u.s.

Source: www.taxformguide.com

Source: www.taxformguide.com

Free 1099NEC Create & File With TaxFormGuide, Companies that paid compensation for services of $600 or more last year to a u.s. Most states do not have an additional state filing.

Source: falconexpenses.com

Source: falconexpenses.com

What is Form 1099NEC for Nonemployee Compensation, Your state participates in the combined federal/state filing (cf/sf) program. You are encouraged to check with your state directly, as your state may have a filing requirement that you.

Source: forst.tax

Source: forst.tax

How to File Your Taxes if You Received a Form 1099NEC, You can also contact your state's tax agency directly. By understanding the rules and processes, you can ensure.

This Means Businesses Will Need To:

There are two types of income that are reported:

Note That, These Pages Are For Information Purposes Only And Should Not Be.

Person that is not its employee (such as a vendor or independent contractor).

Posted in 2025