Retirement Account Contribution Limits 2024 Married Filing

Retirement Account Contribution Limits 2024 Married Filing. For ira contributions limits depend on whether you or a spouse. What to know before contributing to a roth ira.

Your filing status is single, head of household, or married filing separately and you didn’t live with your spouse at any time in 2024 and your modified agi is at least $146,000. What to know before contributing to a roth ira.

The Annual Contribution Limit For A Traditional Ira In 2023 Was.

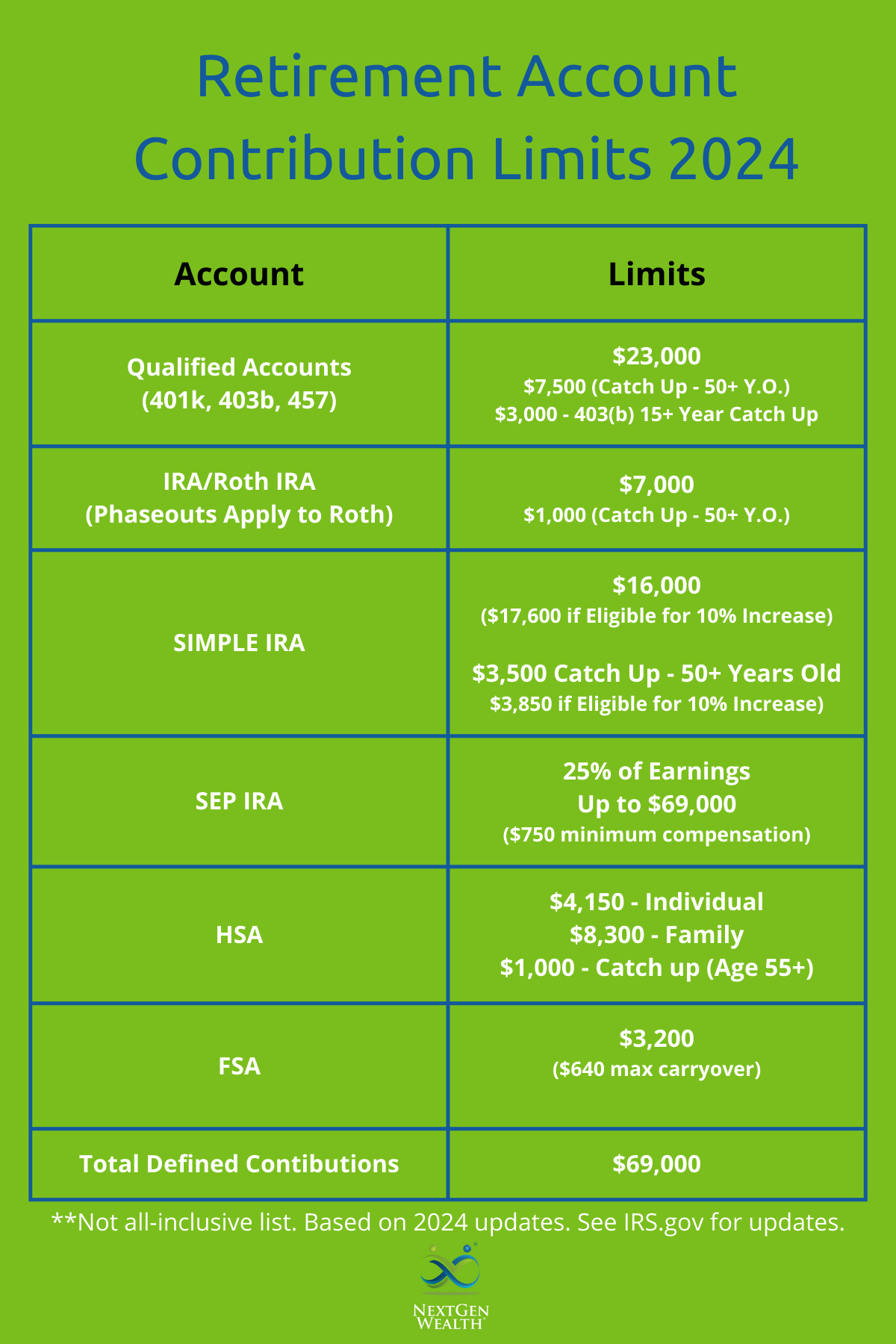

If you are 50 and older, you can contribute an additional $1,000 for a total of $8,000.

In 2024, The Income Limit For The Credit Increased To $76,500 For Married Couples Filing Jointly, Up From $73,000 In 2023.

The standard deduction has increased to $29,200 for married couples filing jointly, up $1,500 from the previous year.

Learn About Tax Deductions, Iras And Work Retirement Plans, Spousal Iras And More.

Images References :

Source: tempuswp.com

Source: tempuswp.com

IRS announces higher retirement account contribution limits for 2024, Information about ira contribution limits. Therefore no contributions are allowed if the.

Source: sandboxfp.com

Source: sandboxfp.com

2024 Contribution Limits for Retirement Plans — Sandbox Financial Partners, For heads of household, the 2024 is. Information about ira contribution limits.

Source: nexgentaxes.com

Source: nexgentaxes.com

Retirement Planning 2024 Retirement Account Contribution Limits, This brings the standard deduction to $29,200 for married couples filing jointly, and $14,600 for single filers. The roth ira contribution limit for 2023 is $6,500 for those under 50, and.

Source: www.internetvibes.net

Source: www.internetvibes.net

Choosing The Best Small Business Retirement Plan For Your Business, For single filers, this number increased by. For 2023 and 2024, married individuals filing separately can only contribute to a roth ira if their modified adjusted gross income (magi) is less than $10,000.

Source: www.advantaira.com

Source: www.advantaira.com

2024 Contribution Limits Announced by the IRS, The roth ira contribution limit for 2023 is $6,500 for those under 50, and. The standard deduction has increased to $29,200 for married couples filing jointly, up $1,500 from the previous year.

Source: www.nextgen-wealth.com

Source: www.nextgen-wealth.com

2024 Retirement Plan Contribution Limits, For ira contributions limits depend on whether you or a spouse. The contribution limit for individual retirement accounts (iras) for the 2024 tax year is $7,000.

Source: elliottwealth.com

Source: elliottwealth.com

Unveiling New 2024 Retirement Account Contribution Limits — Elliott, In 2024, the income limit for the credit increased to $76,500 for married couples filing jointly, up from $73,000 in 2023. What to know before contributing to a roth ira.

Source: www.steadyclimbfp.com

Source: www.steadyclimbfp.com

Increased Retirement Account Contribution Limits for 2024, For the tax year 2024, the maximum contribution to a roth ira is $7,000 for those younger than 50 and $8,000 for those who are 50 or older. Roth ira accounts are subject to income limits.

Source: headtopics.com

Source: headtopics.com

IRS announces 2024 retirement account contribution limits 23,000 for, The standard deduction has increased to $29,200 for married couples filing jointly, up $1,500 from the previous year. Your filing status is single, head of household, or married filing separately and you didn’t live with your spouse at any time in 2024 and your modified agi is at least $146,000.

Source: www.kerberrose401k.com

Source: www.kerberrose401k.com

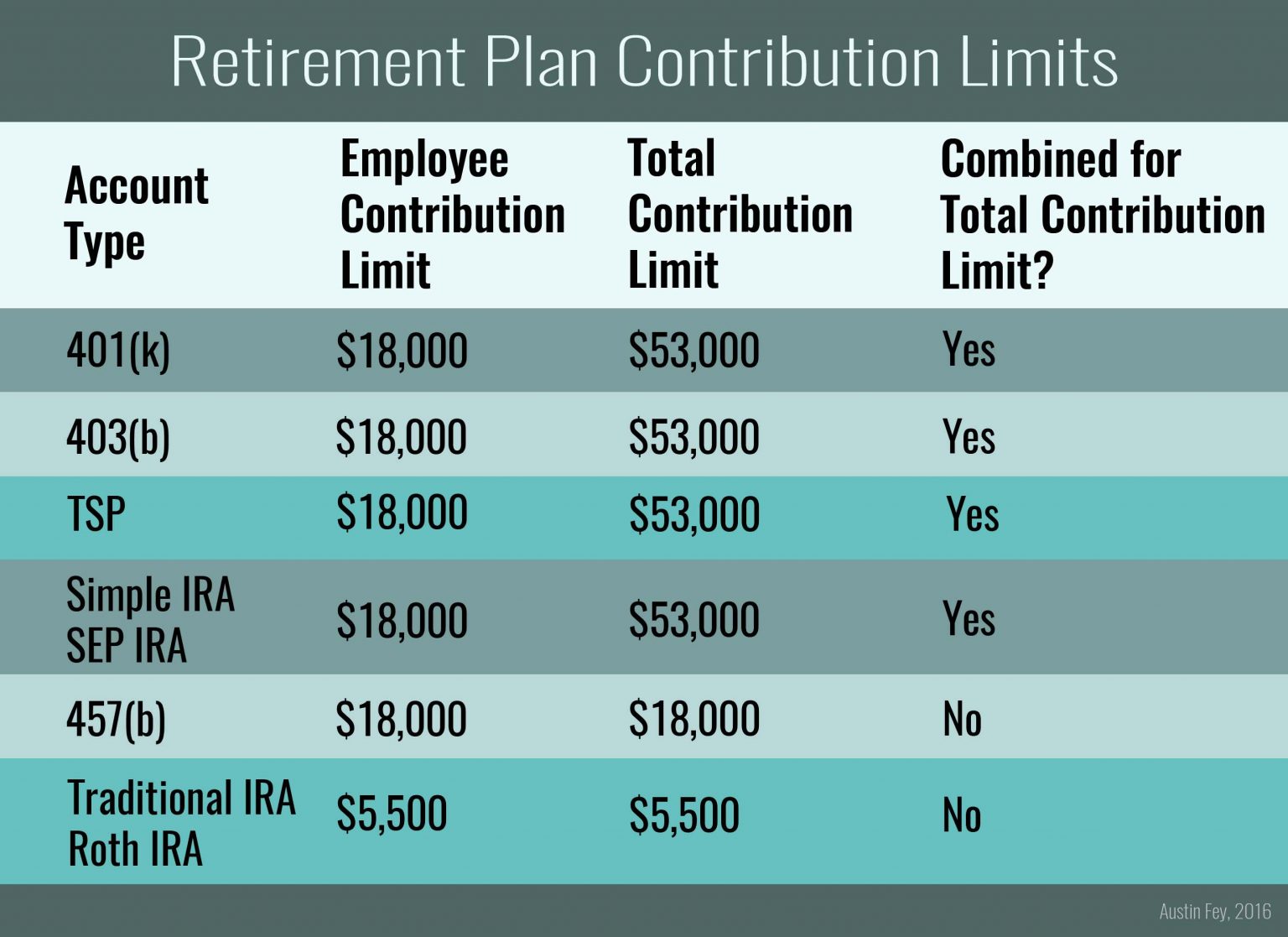

2023 Retirement Plan Limits KerberRose Retirement, The annual contribution limit for a traditional ira in 2023 was. The 2024 annual ira contribution limit is $7,000 for individuals under 50, or $8,000 for 50 or older.

The Roth Ira Contribution Limit For 2023 Is $6,500 For Those Under 50, And.

Your filing status is single, head of household, or married filing separately and you didn’t live with your spouse at any time in 2024 and your modified agi is at least $146,000.

For Heads Of Household, The 2024 Is.

For single filers, this number increased by.